A credit report is a recording of all your payments and collections. Paying bills (electric, water, rent) on time, can be added to a person’s credit report to show they are responsible. According to the Federal Trade Commission, you can request a free credit report every year by visiting:

Annualcreditreport.com or by phone at: 1-877-322-8228.

There are 3 companies that are used in the United States to record and display people’s credit history: Equifax, Experian, and Transunion.

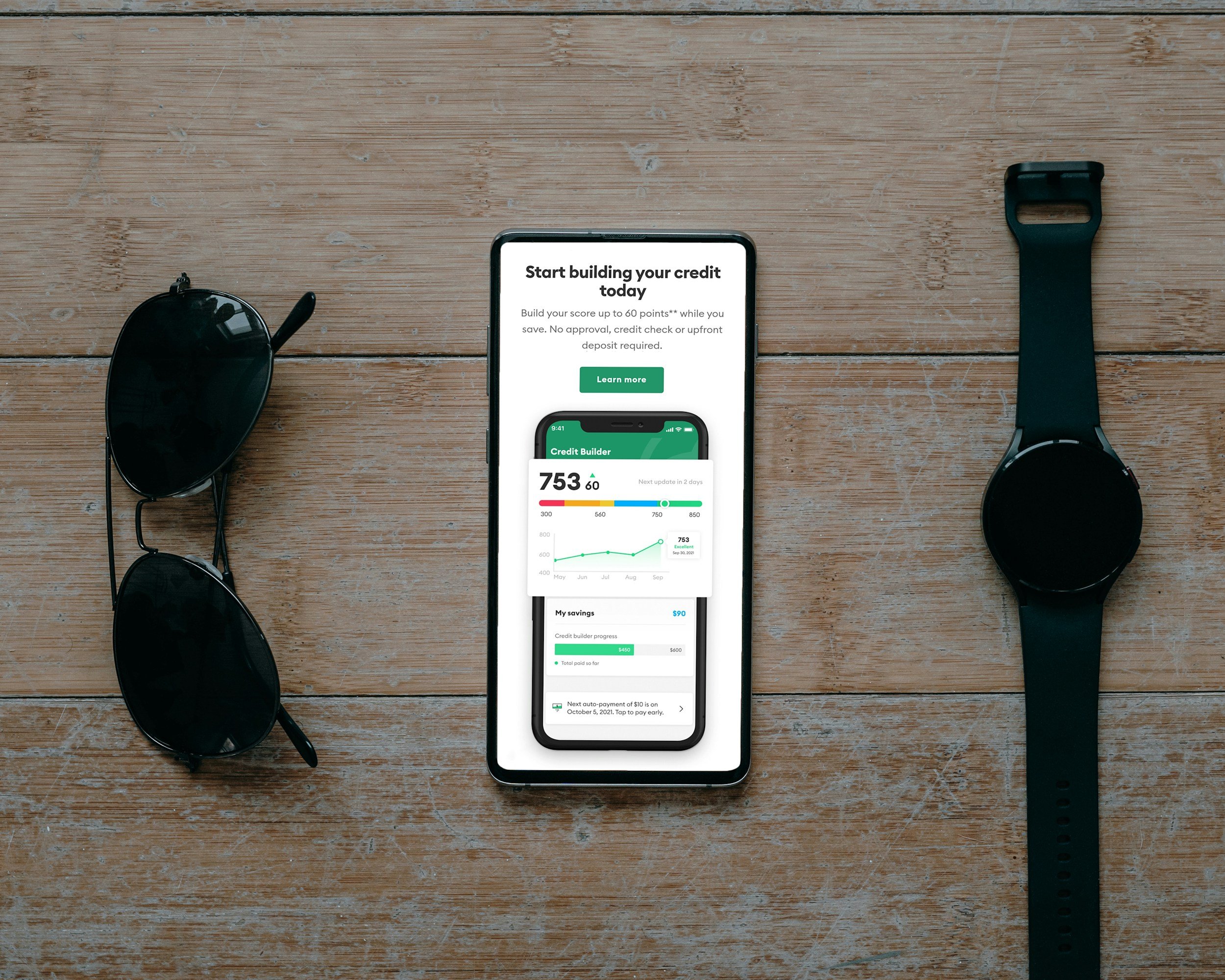

A low credit score can be used to identify someone that has very little credit history or is bad at paying bills on time. A low credit score means a person is less likely to be approved for an application or, if they are approved, they will pay a higher payment.

500

A high credit score can be used to identify someone that has a long credit history or has a record of paying off credit cards and loans on time. Paying rent and utility bills can be used with some credit bureaus like Experian.

760

NOTE: Be careful of websites that ask you to share your bank account number, or debit card details or credit card details. They most likely want to charge you for a service or membership and some may be websites made by scammers.